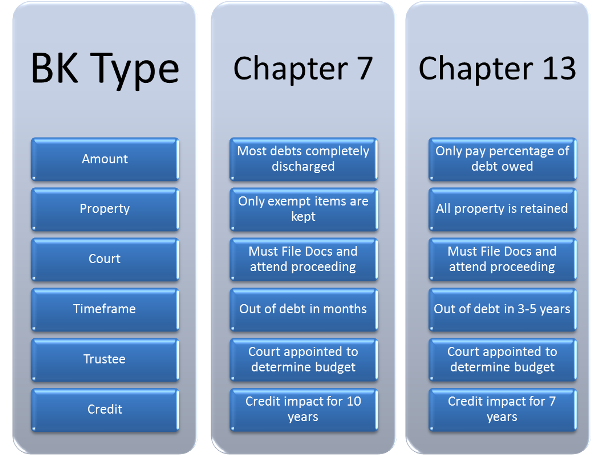

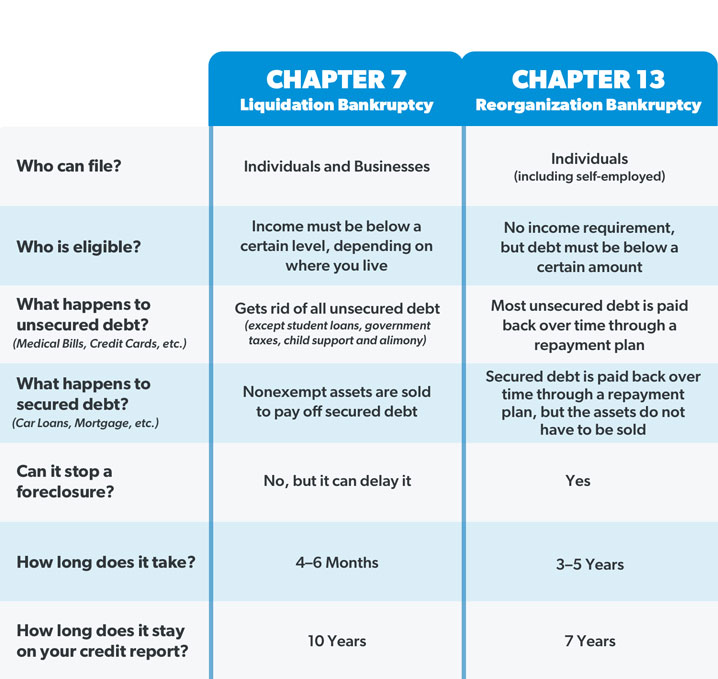

With a Chapter 7 personal bankruptcy you essentially are wiping the slate clean. This is because Chapter 7 typically results in the liquidation of the entire company and Chapter 13 is not available for business entities.

Differences Between Chapter 7 And Chapter 13 Bankruptcy Bankruptcy Attorneys

Differences Between Chapter 7 And Chapter 13 Bankruptcy Bankruptcy Attorneys

Also the cost for filing Chapter 13 can start at 3000 higher than for Chapter 7.

What is the difference between chapter 7 and 13. Bucket 1 is the debt that you are going to keep paying. Chapter 13 will make more sense if youre behind on your mortgage and want to keep your house. It however takes a much different approach than Chapter 7.

Chapter 13 bankruptcy eliminates qualified debt through a repayment plan over a three- or five-year period. Unlike the Chapter 7 bankruptcy process which liquidates significant portions of a debtors assets and distributes the proceeds to creditors Chapter 13 is best viewed as a financial reorganization of the individuals debts allowing the debtor to repay creditors over an extended period of time in accordance with a Chapter 13 plan. The main difference is that the flag for a Chapter 13 bankruptcy is removed from the debtors.

It is recommended for those individuals who have regular income who can pay back at least some of their debts over the course of a 3 to a 5-year repayment plan. Benefits of Chapter 7 vs Chapter 13 Bankruptcy. I know it sounds silly but stick with me it makes sense.

The Main Difference Between a Chapter 7 and Chapter 13 is Debt Forgiveness The big difference between the two main types of bankruptcy has to do with debt forgiveness. Its not an ideal credit situation of course but you can use the time to manage your debts wisely and make consistent on-time payments. Perhaps the biggest challenge with Chapter 13 is its rigidity.

T here are some other interesting differences between chapters and that in some cases it makes financial sense to file a chapter 13 even though you are eligible for chapter 7. Chapter 7 is typically used for low-income debtors who also have no or very little assets. First we split all of your debt between 2 buckets.

Difference between a Chapter 7 and Chapter 13 bankruptcy. Chapter 7 is a liquidation bankruptcy that is designed to eliminate all unsecured debt like medical debts and credit cards. Here are the basic principles behind Chapter 13 bankruptcy.

Chapter 13 however is a reorganization bankruptcy. Here is how I explain the decision between Chapters 7 and 13. This is because Chapter 13 works by reorganizing your debt as opposed to totally wiping it clean.

The majority of bankruptcies filed across the United States are either Chapter 7 or Chapter 13. Chapter 7 bankruptcy remains on your report for up to 10 years and Chapter 13 stays there for up to seven years. The court will total all your secured and unsecured debts and then set a more affordable repayment plan that is.

How Chapter 7 Bankruptcy Works. Chapter 13 is not quite as common but still accounts for 20 of the cases filed in the state of Nevada. Property Chapter 7 resolutions involve selling all nonexempt property.

The main difference between Chapter 7 and Chapter 13 is that a Chapter 7 will allow the debtor to eliminate all dischargeable unsecured debt whereas the Chapter 13 would allow for payments to be made on those debts. Learn when Chapter 7 bankruptcy is a better choice than Chapter 13. Chapter 7 is a popular choice because unlike Chapter 13 it doesnt require filers to pay back a portion of their debts.

Chapter 13 offers an immediate and near-guaranteed debt relief while Chapter 13 provides a more favorable repayment option to avoid foreclosure. Initially Chapter 7 and Chapter 13 have the same effect on a credit score which diminishes over time. If you are running a sole proprietorship however Chapter 13 might be a.

In a chapter 13 you are required to pay some of your debt back. Chapter 7 Chapter 11 and Chapter 13 bankruptcies all impact your credit and not all your debts may be wiped out. If you miss a payment your bankruptcy will be dismissed youll lose your court protection and youll again owe the full amount of your debts.

Which one is right for you depends on your individual financial situation as well as your goals. Unlike Chapter 7 that liquidates almost everything you own a Chapter 13 will only reorganize your debts and give you more time to settle them usually between three to five years. Unlike Chapter 7 where your assets are sold in order to fund debt repayments people who file for Chapter 13 bankruptcy get to keep their assets.

However declaring bankruptcy is not without consequences. With a Chapter 13 resolution you can keep all of your property but you have to pay unsecured creditors to the value of your nonexempt assets. Both Chapter 7 and Chapter 13 present debtors with very appealing options to recover from their current financial crisis.

Chapter 11 is generally the best way to alleviate your liabilities without going out of business. Chapter 13 bankruptcies involve payment plans that typically span 3-5 years. Chapter 7 is the most common type of bankruptcy and is often referred to as a straight bankruptcy.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging getting rid of unsecured debt such as credit cards personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or.