The Risk Management Framework RMF is a set of information security policies and standards the federal government developed by The National Institute of Standards and Technology NIST. Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers.

Key Principles Of Operational Risk Management Rma

Key Principles Of Operational Risk Management Rma

Monitor Additional Resources and Contact Information NIST Risk Management Framework 2.

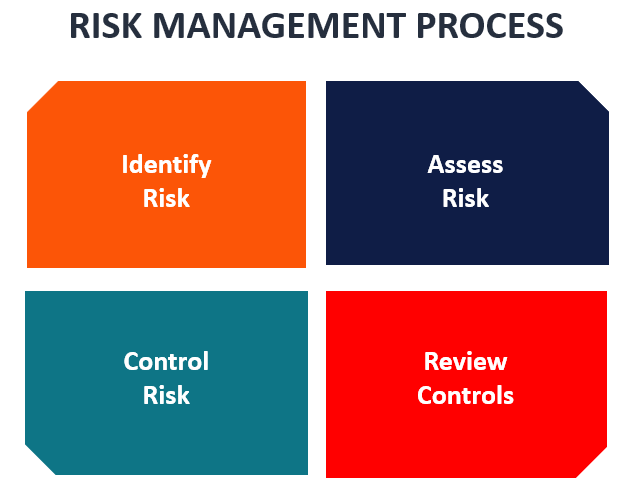

What is risk management framework. The Risk Management Framework RMF is a set of criteria that dictate how the United States government IT systems must be architected secured and monitored. The Cybersecurity Framework can help federal agencies to integrate existing risk management and compliance efforts and structure consistent communication both across teams and with leadership. NIST Risk Management Framework Overview About the NIST Risk Management Framework RMF Supporting Publications The RMF Steps.

The Risk Management Framework provides a process that integrates security privacy and cyber supply chain risk management activities into the system development life cycle. Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification.

The RMF is explicitly covered in the following NIST publications. The Risk Management Framework RMF released by NIST in 2010 as a product of the Joint Task Force Transformation Initiative represented civilian defense and intelligence sector perspectives and recast the certification and accreditation process as an end-to-end security life cycle providing a single common government-wide foundation for security management activities. The risk-based approach to control selection and specification considers effectiveness efficiency and constraints due to applicable laws directives Executive Orders.

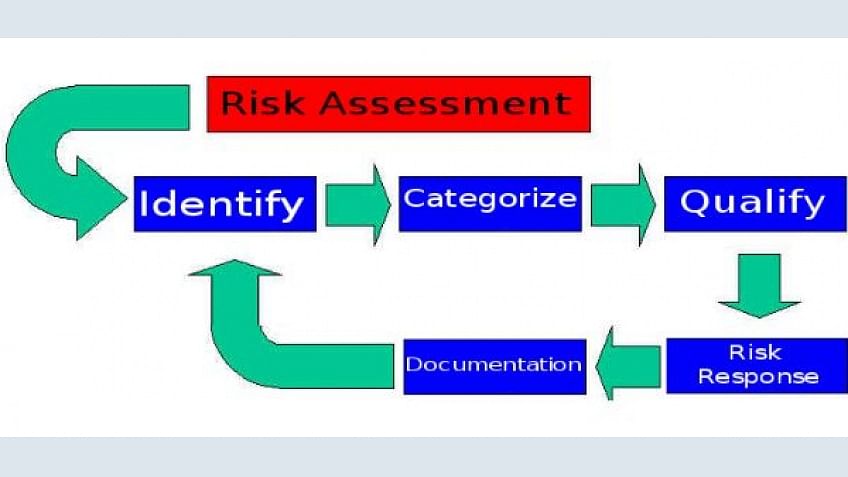

The Risk Management Framework RMF was developed and published by the National Institute of Standards and Technology NIST in 2010 and later adopted by the Department of Defense DoD to act as. A risk management framework RMF is the structured process used to identify potential threats to an organisation and to define the strategy for eliminating or minimising the impact of these risks as well as the mechanisms to effectively monitor and evaluate this strategy. Originally developed by the Department of Defense DoD the RMF was adopted by the rest of the US federal information systems in 2010.

It articulates the requirements for identifying managing and monitoring risks. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification. A risk management framework is an essential philosophy for approaching security work.

Following the risk management framework introduced here is by definition a full life-cycle activity. Special Publication 800-37 Guide for Applying the Risk Management Framework to Federal Information Systems describes. It clarifies how risk and opportunity are considered in.

The Risk Management Framework can be applied in all phases of the sys-tem development life cycle eg acquisition development operations. This Risk Management Framework the Framework is the foundation for building the value of risk management empowering people to effectively manage uncertainty. In addition the framework can be used to guide the management of many different types of risk eg acquisition program risk software development.