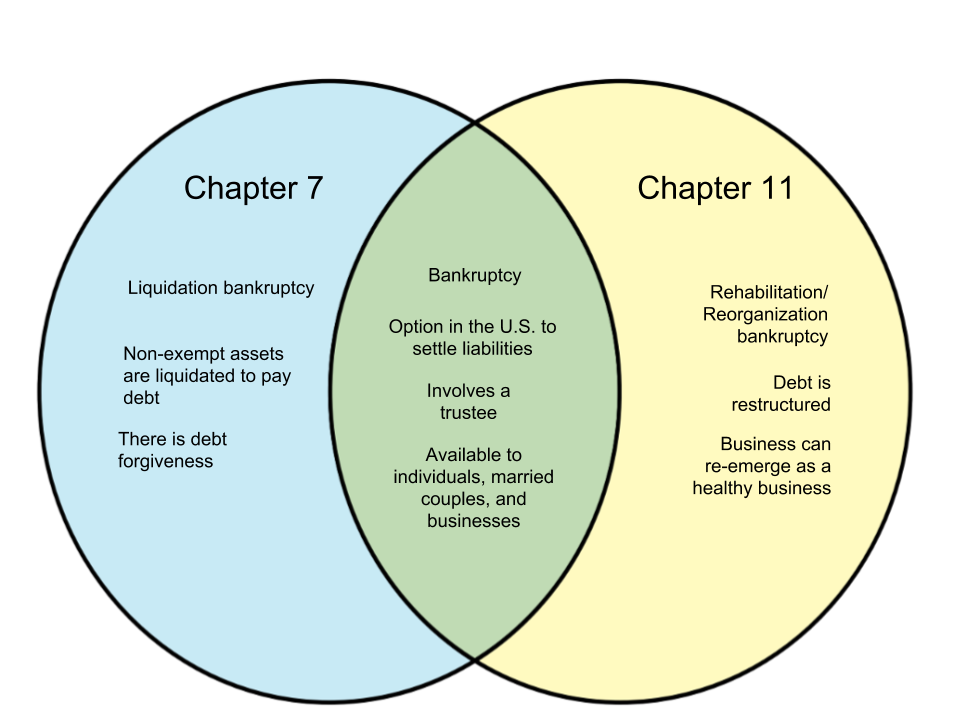

This type of bankruptcy provides many advantages that Chapter 7 and 13 cant. Chapter 11 is a reorganization bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

Chapter 13 Bankruptcy Avondale Bankruptcy Attorneys

Chapter 13 Bankruptcy Avondale Bankruptcy Attorneys

A Chapter 7 will in effect put a business out of business while a Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy.

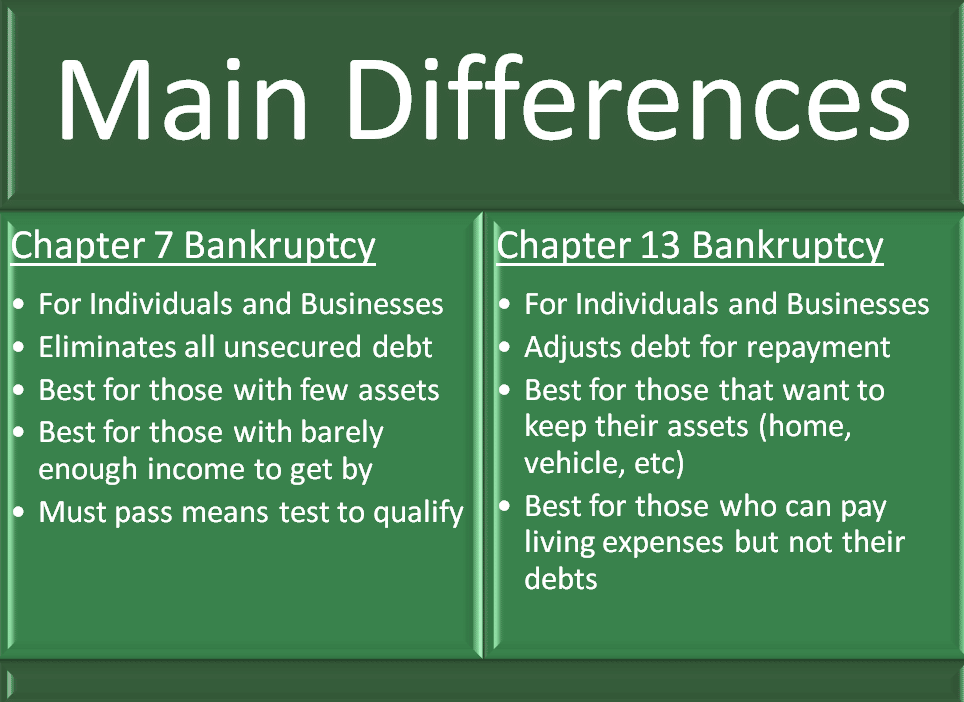

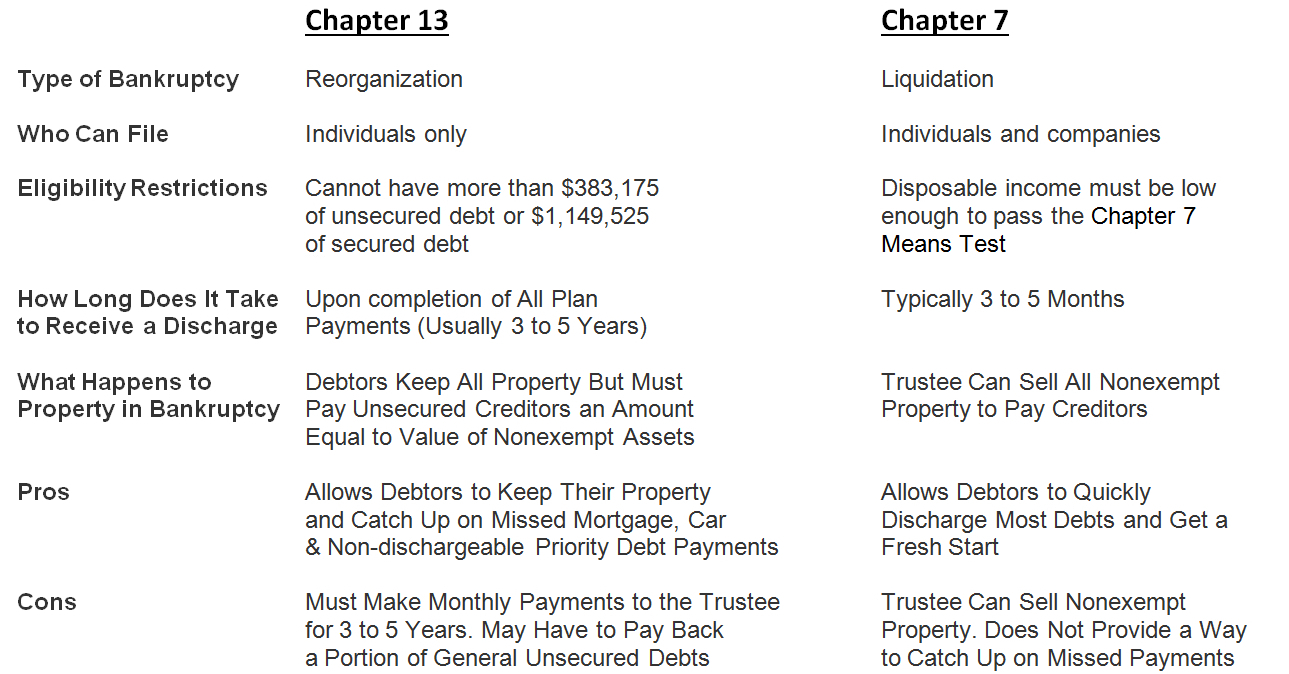

What's the difference between chapter 7 and chapter 11 bankruptcy. In addition to Chapters 7 and 11 you may want to look at Chapter 13 bankruptcy. In contrast to chapter 7 the debtor remains in control of business operations under chapter 11 and doesnt sell off all of its assets. Chapter 11 is generally the best way to alleviate your liabilities without going out of business.

Chapter 7 is a liquidation bankruptcy that doesnt require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 stays on your credit for seven years from filing so this can hinder your financial goals for a long time. The length of your plan will depend on its complexity.

Ad Chapter 7 Bankruptcy Mn Search Now. Considered the most complicated of the three bankruptcy processes Chapter 11 should always have. The Chapter 11 is a reorganization bankruptcy for the business.

This is because Chapter 7 typically results in the liquidation of the entire company and Chapter 13 is not available for business entities. Over 85 Million Visitors. We explored Chapter 11 bankruptcy last because it focuses mainly on businesses who intend to stay afloat and get a chance to reorder finances ie.

Chapter 11 bankruptcy is a reorganization bankruptcy and is available to individuals and businesses. Learn when Chapter 7 bankruptcy is a better choice than Chapter 13. Chapter 11 cases are by far the most complicated of bankruptcy cases and as a result there are very few law firms that handle chapter 11 cases but many times individuals and companies cannot obtain the relief they need under chapter.

Because the debt involved tends to be high creditors are extremely concerned about getting a good portion of their money back. The biggest difference between Chapter 11 and Chapter 7 is that Chapter 11 is a reorganization bankruptcy while Chapter 7 is a liquidation bankruptcy. Specifically Chapter 11 reorganization bankruptcy is most commonly implemented when big.

Ad Chapter 7 Bankruptcy Mn Search Now. A Chapter 7 bankruptcy will. Chapter 11 can help a business stay.

Chapter 7 is a popular choice because unlike Chapter 13 it doesnt require filers to pay back a portion of their debts. Most people who file for bankruptcy choose to use Chapter 7 if they meet the eligibility requirements. Over 85 Million Visitors.

Assess Chapter 7Chapter 11Chapter 13 bankruptcy options. Though used mainly by large corporations it can also be beneficial to small business owners. The main difference between Chapter 7 and Chapter 11 bankruptcy is that under a Chapter 7 bankruptcy filing the debtors assets are sold off to pay the lenders creditors whereas in Chapter 11 the debtor negotiates with creditors to alter the terms of the loan without having to liquidate sell off assets.

The main difference between Chapter 7 bankruptcy and Chapter 11 bankruptcy is that debts are not discharged. Below we explain the differences between Chapter 11 and Chapter 7 bankruptcy for businesses. Chapter 11 for a business is that Chapter 11 allows a business to continue operating.

Chapter 7 gives both low-income earners and high-income earners exempt from qualification requirements a fresh start by erasing qualifying debt. What chapter 11 does is allow a business to come out of bankruptcy as a. Business Cant Keep Assets.

Instead repayments are re-organized. Chapter 11 bankruptcy is designed to allow businesses to continue to operate while repaying necessary debts and restructuring the company for long-term success. Chapter 13 is for individuals as is Chapter 11 though the latter was originally designed for corporations.

Chapter 7 can help a business close by selling off its property to pay creditors. In the face of mounting debts. While Chapter 7 and Chapter 13 are bankruptcies most often used by individuals Chapter 11 is generally reserved for businesses seeking reorganization of their finances.

So if you file for Chapter 7 youll have to sell your assets to pay as many creditors as possible. Chapter 11 and Chapter 13 Bankruptcy Chapter 11 and Chapter 13 filings are similar. Chapter 11 and Businesses.

Filing for Chapter 7 means the debtor cannot file for this type of bankruptcy for another seven years. Chapter 11 is rarely used for individuals. Chapter 11 Reorganization Bankruptcy.

Corporations partnerships and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed. The difference between Chapter 7 vs.

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Do We Have Chapter 7 Or Chapter 13 Bankruptcy In Canada

Do We Have Chapter 7 Or Chapter 13 Bankruptcy In Canada

Blog Ball Bankruptcy Las Vegas

Blog Ball Bankruptcy Las Vegas

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

What Are The Different Types Of Bankruptcies Ramseysolutions Com

What Are The Different Types Of Bankruptcies Ramseysolutions Com

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

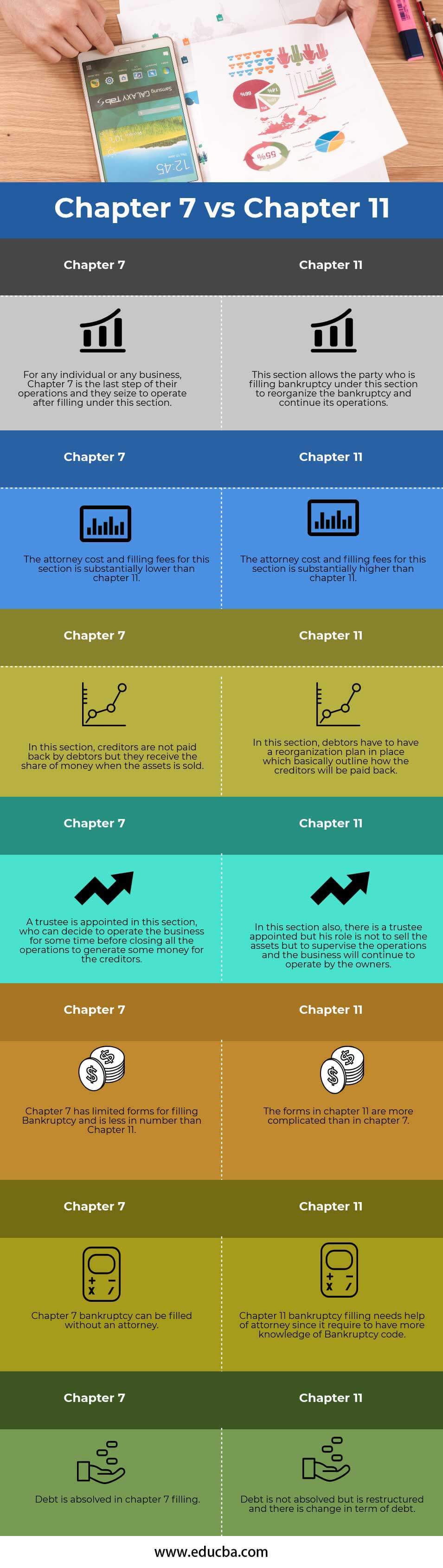

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

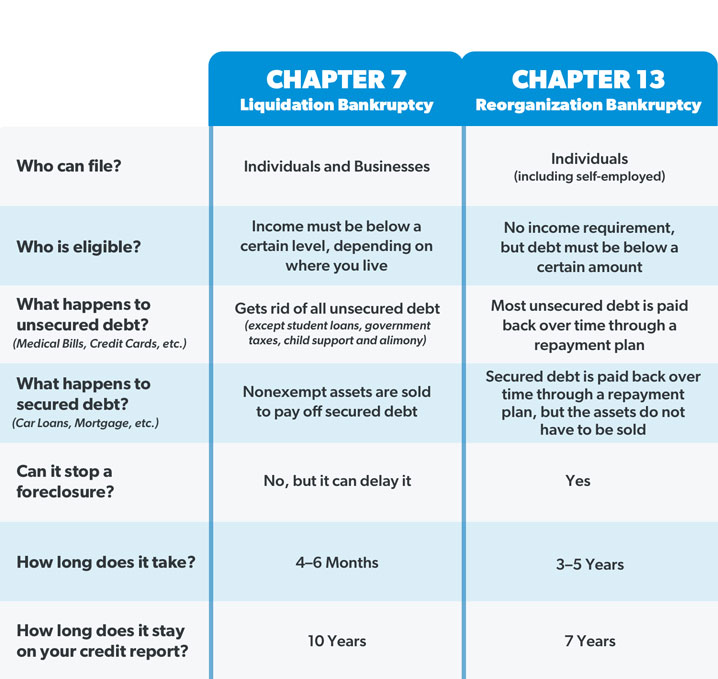

Chapter 7 Vs Chapter 13 What Is The Difference All About Infographic

Alikhan Law Office Llc In Las Vegas Nevada 702 374 6619

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Advantage Ccs

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Advantage Ccs

Chapter 7 Vs Chapter 13 Bankruptcy Explained

Chapter 7 Vs Chapter 13 Bankruptcy Explained

No comments:

Post a Comment

Note: only a member of this blog may post a comment.